Starting a Company in America: All the Steps to Establishing a Successful Company in 2025

Starting a company in the United States involves navigating various legal, tax, and regulatory frameworks — especially for non-resident Arab entrepreneurs. It requires managing these different aspects to lay a strong foundation for your business so it can fully benefit from the legal and tax advantages and tap into the vast opportunities of the U.S. market.

In this article, we’ll answer the most common questions that may come to mind when considering starting a U.S. business, and we’ll walk you through the necessary steps and services to help you complete the process smoothly.

Before You Start

Can non-residents start a business in the U.S.?

Yes, non-residents can start a business in the U.S.

The U.S. allows foreigners to easily form companies even if they are not residents. This gives entrepreneurs worldwide the opportunity to access massive markets, open international bank accounts, and work with global payment systems like Stripe and PayPal.

While the process may seem complex due to legal and tax requirements, it's entirely achievable by following the correct steps.

Why do many Arabs choose to start companies in the U.S.?

To access one of the world’s largest commercial markets, which is full of limitless opportunities across sectors like technology, e-commerce, and energy. With over 330 million people, the U.S. offers your company access to a vast and diverse customer base.

Legal Protection & Tax Benefits

Limited Personal Liability: Structures like LLCs offer strong protection to investors — meaning your personal assets (like your house or savings) are protected if your business faces legal or financial issues.

Tax Incentives: Some U.S. states like Delaware and Wyoming don’t impose corporate income tax, making them attractive for foreign investors.

Access to Global Payment Platforms

With services like Stripe, PayPal, Amazon, Shopify, and eBay, it's much easier to sell your products or services internationally, especially compared to many other countries.

Ease of Funding and Attracting Investment

U.S. companies, especially in tech, enjoy a solid reputation globally, making it easier to attract venture capital and institutional investors compared to businesses based in other markets.

Resident vs. Non-Resident: Legal Distinction

Resident: Someone who lives in the U.S. long-term or holds a Green Card. They are subject to federal and state laws, including taxes on worldwide income.

Non-Resident (Aliens): Those who do not reside in the U.S. permanently but want to establish a business. They’re generally only taxed on U.S.-sourced income.

If your services/products are offered from outside the U.S., the income is usually not considered U.S.-sourced, and thus not subject to U.S. federal taxes. For example:

A digital marketer operating from Morocco serving U.S. clients remotely — not taxable in the U.S.

A designer selling digital products from Turkey via a U.S.-based LLC — not considered U.S.-sourced as long as operations happen abroad.

Even if you accept payments in USD or via U.S.-based gateways, your income isn’t taxed federally unless you’re operating from inside the U.S.

This model gives foreign entrepreneurs a golden opportunity to start an American LLC and benefit from financial credibility and access to global systems without complex U.S. tax implications — as long as business is conducted from abroad.

Types of U.S. Business Entities (LLC vs. C-Corp)

1. LLC (Limited Liability Company)

Combines the legal protection of corporations with the tax and management flexibility of partnerships.

Pros:

Personal liability protection

Flexible tax treatment (pass-through or corporate)

Simple structure, low startup/maintenance costs

No requirement for a board of directors or annual meetings

Ideal for small businesses or freelancers

Cons:

Can't issue stock (less attractive to large investors)

Less suitable for high-growth tech startups

2. C-Corp

A separate legal entity from its owners. Ideal for companies planning to raise capital or go public.

Pros:

Can issue stock and attract major investors

Easier to transfer ownership

Corporate tax benefits

Personal liability protection

Cons:

Double taxation (company pays taxes, then shareholders pay on dividends)

Complex governance structure (board, reports, meetings)

Higher costs and stricter legal compliance

Best for: Tech startups, large-scale businesses planning to scale or raise funding.

Choosing the Best State for Incorporation

Delaware

Delaware

Most popular among startups

Business-friendly laws, specialized courts

Annual franchise tax around $300

Higher setup costs

Wyoming

No corporate/personal income tax

High privacy (owners can remain anonymous)

Low annual fees (~$60)

Less recognized among VCs

Nevada

No corporate/personal income tax

Strong privacy

Higher annual fees and stricter reporting

Why Wyoming?

Low taxes and fees

High privacy

Simple setup and maintenance

Ideal for foreign entrepreneurs

10 Steps to Start a U.S. Company as a Non-Resident

1. Choose Your Company Type:

LLC (best for flexibility)

C-Corp (best for investors/public offering)

2. Select a State:

Based on tax, legal climate, and business goals

3. Appoint a Registered Agent:

A U.S.-based representative to receive legal documents

4. Choose a Company Name:

Must be unique and comply with local naming laws

5. File Formation Documents:

"Articles of Organization" (LLC) or "Articles of Incorporation" (C-Corp)

6. Get an EIN (Employer Identification Number):

Required for taxes, bank accounts, and hiring

Apply via IRS website

7. Open a U.S. Business Bank Account:

Typically requires EIN and U.S. address

8. Apply for Licenses/Permits:

Depending on your business activity

9. Create an Operating Agreement (for LLC):

Outlines ownership, roles, and financial structure

10. Stay Compliant with Annual Reports and Taxes:

Submit required filings and pay state/federal taxes

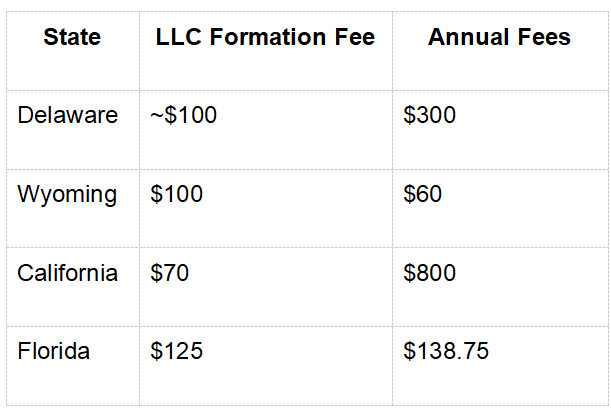

Cost of Forming a U.S. Company

Additional Costs:

Registered Agent: $100–$300/year

Annual Reports: $50–$200 depending on state and entity type

Post-Formation Responsibilities

Annual Reports: Update company info annually

Federal/State Taxes: File based on revenue and structure

Sales Tax Filings: If applicable

Income Tax on Employee Wages

Business Licenses/Permits: Depending on your industry

Update State Records: If there are company changes

Recommended Service for Company Formation

If you're a non-resident looking for reliable, affordable help — Northwest Registered Agent is a solid choice:

$39 (plus state fees) to start

Free registered agent for the first year

Legal/tax guidance

Privacy protection

Transparent, no upsells

Compare:

Stripe Atlas: ~$500

Clemta: From $497

Northwest saves $450+ with no compromise on quality.

Final Tip: Stay Compliant!

Some states require additional documents or tax registrations within 30–90 days of incorporation.

Be sure to consult your agent or a trusted service like Northwest to stay up-to-date and legally compliant.